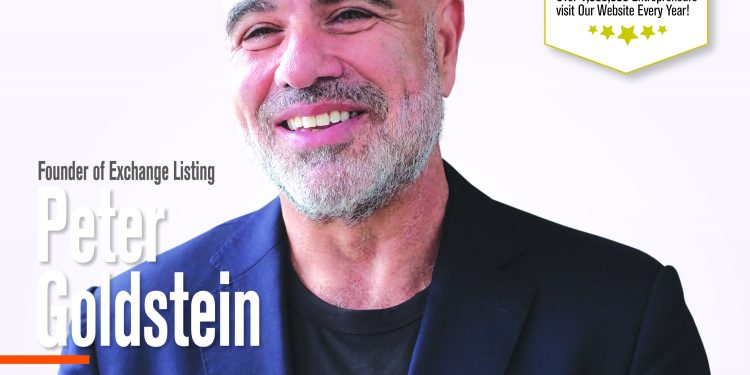

Founder of Exchange Listing Peter Goldstein Charts a New Course for ASEAN Companies Entering the U.S. Capital Market

As interest in the U.S. capital markets continues to grow among ASEAN enterprises, a high-level summit focusing on IPO readiness, strategic planning, and cross-border capital execution was successfully held at Nasdaq on April 15, 2025. Spearheaded by Peter Goldstein, founder of Exchange Listing, LLC, the “IPO Summit” brought together IPO professionals and stakeholders to address the latest trends and challenges in the U.S. public listing space. In this exclusive interview with VCNews, Goldstein offers a post-summit analysis, shares insights into the opportunities and pitfalls for ASEAN companies aiming to go public in the U.S., and gives a sneak peek into his upcoming book, The Investor’s IPO.

Goldstein emphasizes that while U.S. markets offer robust opportunities, they also demand rigorous corporate governance. In an era where technology and global regulatory frameworks are evolving rapidly, both entrepreneurs and investors must remain grounded in financial fundamentals.

High-Caliber ASEAN Entrepreneurs Demonstrate Strong IPO Intent

Reflecting on the IPO Summit, Goldstein noted that the April 15 event was an invitation-only gathering and attracted a select group of serious, well-prepared entrepreneurs from Southeast Asia.

“Their engagement was impressive, and the questions were deep and insightful. It’s clear they’re not just curious — they’re genuinely preparing to take the next step into the international capital markets,” Goldstein remarked.

U.S. IPOs: Three Common Blind Spots to Avoid

Based on his extensive experience, Goldstein highlighted three key areas where ASEAN companies often fall short when pursuing a U.S. IPO:

1. Corporate Governance & Disclosure Compliance

“Many first-time issuers underestimate the time and resources needed to meet U.S. compliance standards,” he explained. U.S. markets impose high expectations on board structure, transparency, and overall governance.

2. Financial Reporting Preparedness

U.S. IPO filings must comply with GAAP or IFRS, both of which require time-consuming preparations. Goldstein advises companies to assemble qualified financial teams early and begin internal training on reporting standards.

3. Investor Relations Strategy

Goldstein underscored the importance of storytelling: “Before going public, companies must start communicating their value proposition clearly — who they are, what they do, and why they matter.”

Immersive Experience Helps Companies Create Actionable IPO Roadmaps

The summit was not just theoretical — it emphasized a practical, immersive experience. Attendees walked away with detailed IPO roadmaps that included timelines, cost structures, and strategic milestones.

“They gained real-world feedback from seasoned professionals and learned from successful IPO case studies. We covered everything from governance structures to investor strategies and how to avoid common pitfalls.”

Scaling Up: IPO Summit Heads to Asia

Looking ahead, Goldstein shared that the IPO Summit will expand its reach across Asia.

“We plan to bring our educational resources to more ASEAN regions and help foreign private issuers understand how to successfully list in the U.S.”

He revealed plans for a regional summit in Kuala Lumpur this July, followed by another in Hong Kong or elsewhere in Asia later this year. In addition to the flagship Nasdaq summit held annually, smaller regional events will be hosted every six months across Asia, allowing more companies to access high-quality knowledge and investor networks.

The Investor’s IPO: A New Book for the Investing Public

Goldstein also introduced his forthcoming book, The Investor’s IPO, which will be released on Amazon on July 8, 2025. Unlike his previous title, Entrepreneur’s IPO, which targeted founders, this new work focuses on the investor’s perspective.

“I want to help investors — especially retail and high-net-worth individuals — better understand the IPO landscape and make data-informed decisions.”

The book includes real-world IPO case studies and provides tools to identify red flags and growth opportunities beyond the market hype. A limited number of signed copies will be available at upcoming IPO summits.

Risk Assessment Tips: Focus on Insider Ownership and Revenue Quality

When asked how investors should evaluate upcoming IPOs, Goldstein advised:

- Track Founder & Management Ownership: “High insider retention shows confidence in the company’s future.”

- Evaluate Revenue Stability: Investors should focus on financial fundamentals and governance, not just market noise.

“Board composition and governance mechanisms are directly tied to long-term shareholder value,” he added.

Navigating the Noise: Discipline in the Age of Disruption

Goldstein noted that while emerging technologies like AI and blockchain have fueled IPO activity, they also create significant market noise.

“We saw this during the dot-com bubble in the early 2000s — many companies raised money on hype but couldn’t deliver real value.”

He advised investors to look beyond flashy concepts and assess true product-market fit. Curiosity is essential, but so is continual learning and self-discipline.

Investment Focus: Traditional Sectors Enhanced by Technology

While tech IPOs often dominate headlines, Goldstein prefers companies that blend traditional industries with tech-driven transformation.

“These businesses may not seem sexy, but they often generate predictable revenues and sustainable growth,” he said.

He is particularly bullish on Southeast Asia, which he believes is poised for significant expansion over the next 5 to 10 years.

欲了解更多, 请参阅 《创投时代》(VCNews)

电子报 www.vc-news.com.cn