Wong Kai Cheong: Driving AsiaFIN’s Mission to Empower Global Banks, Corporations, and Capital Markets

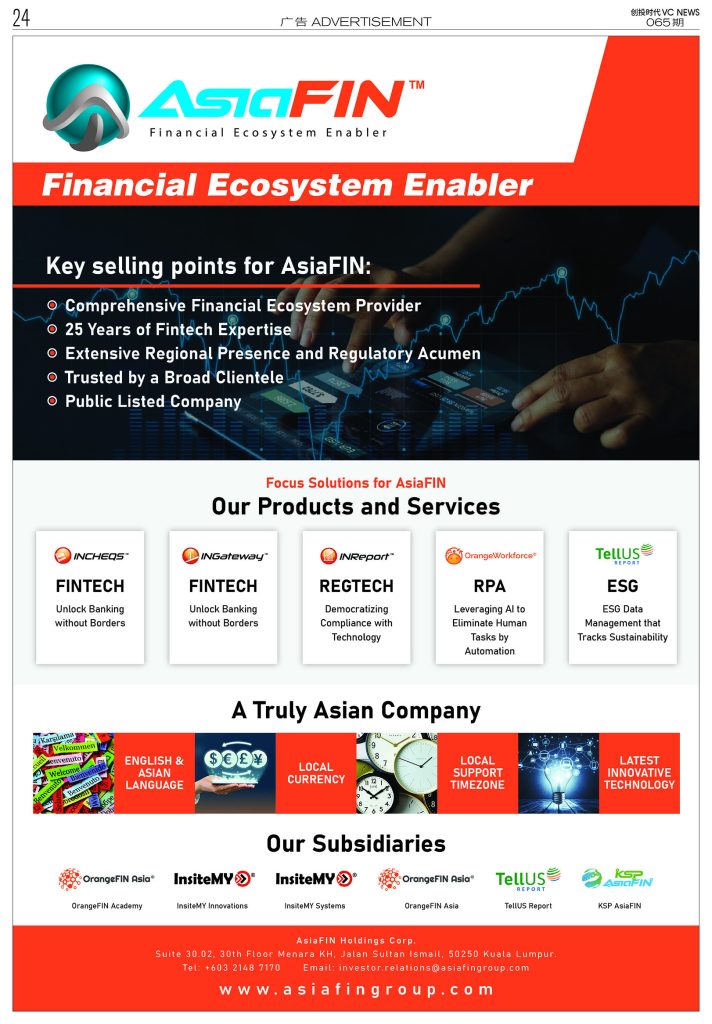

AsiaFIN Holdings Corp., a publicly traded fintech company listed on the OTCQB Market in the United States, is headquartered in Kuala Lumpur, Malaysia. The company is making waves across the ASEAN region with its cutting-edge financial processing solutions, powered by Artificial Intelligence (AI) and Robotic Process Automation (RPA). By transforming payment systems and compliance reporting for financial institutions, AsiaFIN is positioning itself as a key player in the region’s evolving fintech ecosystem.

Through its subsidiaries, AsiaFIN provides comprehensive market research and consultancy services in payment processing, Regulatory Technology (RegTech), Robotic Process Automation (RPA), and self-service unattended payments. With clients across legal, property technology (proptech), healthtech, and logistics sectors, the company is also making bold moves into ESG (Environmental, Social, and Governance) data management through its new business segment, TellUS Report.

To gain deeper insight into AsiaFIN’s latest strategies and global expansion plans, 《VCNews》sat down for an exclusive interview with the company’s p CEO, Wong Kai Cheong (KC). The following is the full interview.

VCNews: Could you briefly introduce AsiaFIN Holdings’ core business and service offerings?

KC: AsiaFIN’s core offerings span across several key areas of financial technology. One of our main product automates Cheque Clearing. We currently support approximately three central banks and operate in nine countries in this domain.

In the RegTech (Regulatory Technology), we’ve developed our own reporting solution. This solution is designed to support a wide range of regulatory compliance requirements, including central bank statistical reporting, external assets and liabilities reporting, credit reporting, and more.

We also offer Robotic Process Automation (RPA), with proprietary robotic software we’ve developed in-house. While we serve banks, our RPA tools are also utilized across 22 other industries, bringing automation and efficiency to a wide range of business operations.

Lastly, we have ventured into ESG consuting and reporting. Leveraging our RegTech engine, we help large corporations—particularly public-listed companies on Bursa Malaysia—comply with carbon net-zero reporting requirements and other ESG-related disclosures, including those mandated by Bank Negara Malaysia.

VCNews: What key strengths or competitive advantages do you believe have enabled your company to gain strong acceptance in the market?

KC : One of our greatest strengths is our longevity and experience. We’ve been in business for over 25 years, and during this time, we’ve built a proven track record of success. Today, we proudly serve more than 90 banking clients and over 100 corporate clients across various sectors.

Our RegTech solutions are a core part of our offerings and have continued to evolve with market needs. For example, we now support e-invoicing, which was recently mandated in Malaysia.

Our reputation and reliability are what truly set us apart. Much of our business growth over the years has been driven by word of mouth and long-term client relationships.

Unlike many tech companies, we have not relied on social media or advertising for promotion. One of the reasons for this is that we are bound by strict non-disclosure agreements (NDAs) with our banking clients. However, with the establishment of AsiaFIN Holdings as a public company, we have recently begun to increase our visibility. This is especially important now, as we want our shareholders to better understand the nature and value of our business.

VCNews: AsiaFIN is committed to transforming the financial industry through AI and RPA. In your view, what are the most significant benefits these technologies bring to your clients?

KC : We began developing our AI and RPA capabilities as early as 2018, well before these technologies became mainstream. We built our own RPA and AI system. Today, the system has been successfully deployed and operational with a local bank for several years. Since then, we’ve expanded our AI and RPA offerings to other clients in countries such as Malaysia and Pakistan, and are currently entering the Saudi Arabian market.

The key value these technologies offer is cost efficiency, particularly in reducing labor expenses. By automating these processes, our clients can reallocate their human resources to more strategic roles.

VCNews: AsiaFIN is about to launch a new ESG data service segment under TellUS Report. Could you share the vision and market positioning for this new business line?

KC : We established TellUS Report in 2023, and officially launched its ESG data services in 2024. The primary goal of TellUS Report is to support banks and large corporations in meeting the growing requirements for ESG reporting, particularly focusing on carbon footprint, social impact, and governance compliance.

We foresee strong potential in this field, especially as Bursa Malaysia, Bank Negara Malaysia, and other regional regulators are increasingly mandating ESG disclosures. These regulatory shifts are creating an urgent need for reliable data and structured reporting solutions.

Currently, our ESG services are focused on Malaysia, Indonesia, and the Philippines. We do see potential in larger international markets like Saudi Arabia.

VCNews: The company is actively expanding its presence in Asia through strategic alliances and partnerships. What are the main challenges the company faces in tapping into this vast market?

KC : At AsiaFIN, we aspire to be a truly Asian fintech company. However, tapping into the diverse economies across Asia presents several challenges. Among the ten key economies we target, our biggest hurdle is identifying and partnering with the right players—specifically, those who are number one or number two in their respective sectors.

We are highly selective because we aim to work only with market leaders who are deeply embedded in their local ecosystems and fully aligned with our core business offerings. That’s why, despite the vast opportunities, we are currently active in only a few countries where we’ve successfully found such strategic partners.

To date, we’ve established a presence in Malaysia, Indonesia, Singapore, Myanmar, the Philippines, Thailand, Pakistan, and Bangladesh. Additionally, we’ve recently signed a strategic contract with a major government financial institution in Saudi Arabia, marking a significant milestone in our Middle East expansion.

VCNews: As a publicly listed company in the U.S., how has AsiaFIN built its credibility in the global capital markets and increased its international visibility?

KC : AsiaFIN is currently listed on the OTCQB Market in the United States. While this listing provides us with access to global capital markets, one of the main challenges we face on the OTCQB is limited trading liquidity, which can affect investor visibility and market perception.

To address this, we are taking proactive steps to enhance our global profile and investor engagement. One of our key strategies is to leverage social media platforms to communicate our growth story more effectively.

However, due to the non-disclosure agreements (NDAs) signed with many of our clients—particularly in the banking sector—we are restricted from publicly naming them, which naturally limits the exposure of some of our key achievements.

We are currently establishing alliances with partners in the Nordic region, including Sweden, Finland, Norway, and Denmark. These efforts are designed to increase international awareness and credibility, especially in service-driven markets.

VCNews: Last but not least, could you share your company’s plans and vision for the next five years?

KC : At present, we’ve successfully entered the Saudi Arabian market through a signed contract with a major government financial institution. Over the next two years, our primary focus will be to strengthen our presence in Saudi Arabia and subsequently expand into other Middle East markets such as the UAE, Kuwait, Bahrain, and Qatar.

We also remain committed to establishing a strong footprint in the United States. By 2026, we aim to significantly increase our U.S. market presence. To prepare for this, we participated in the Quay Acceleration program, a prestigious platform that supports international companies entering the U.S. market. Through this program, we’ve had the opportunity to present to multiple potential investors, including major banks and institutions in New York and New Jersey.

欲了解更多, 请参阅 《创投时代》(VCNews)

电子报 www.vc-news.com.cn